Regulations on Non-Banking Financial Institutions to be rehauled in 2024

The National Bank of Ukraine plans to adopt the secondary legislation effective as of 1 January 2024, on the activities of non-banking financial institutions (NBFI) in Ukraine. The recast of the regulations comprises fundamental changes targeting to implement new statutory provisions on the NBFIs generally, as well as specific laws on insurance companies and credit unions, which are also expected to apply as of the start of 2024.

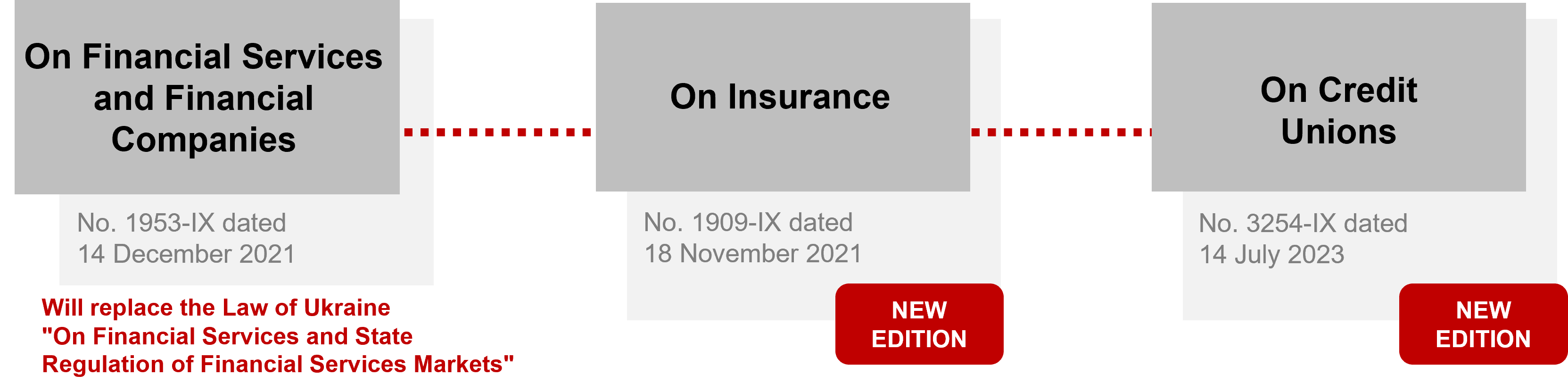

New laws to look out for:

Currently, the NBU is developing by-laws to adapt regulatory requirements to the amended laws. Changes will concern terms of licensing, prudential supervision, solvency requirements, provisioning and internal control systems of financial service providers, etc. The NBU is also going to establish a detailed procedure for conducting activities in Ukraine by foreign providers of financial services.

In particular, drafts of the following regulatory acts have already been made public:

- Draft Regulations on the authorization of financial service providers and the conditions for their activities in the provision of financial services

- Draft Regulation on the procedure for supervision of non-banking financial groups on a consolidated basis

- Draft Regulation on prudential requirements for financial companies

- Draft Regulation on requirements for the insurer's management system

- Draft Regulations on establishing requirements for ensuring the solvency and investment activity of the insurer

- Draft Regulation on the procedure for keeping records by the insurer of contracts related to the implementation of insurance activities and requirements for the protection of the insurer's information

- Draft Regulation on the peculiarities of the activities of united credit unions

- Draft Regulation on the reorganization and liquidation of the credit union by decision of the general meeting of the members of the credit union

These and other draft regulations, as well as information on their regulatory impact on the financial services market, are available for review on the NBU’s website.

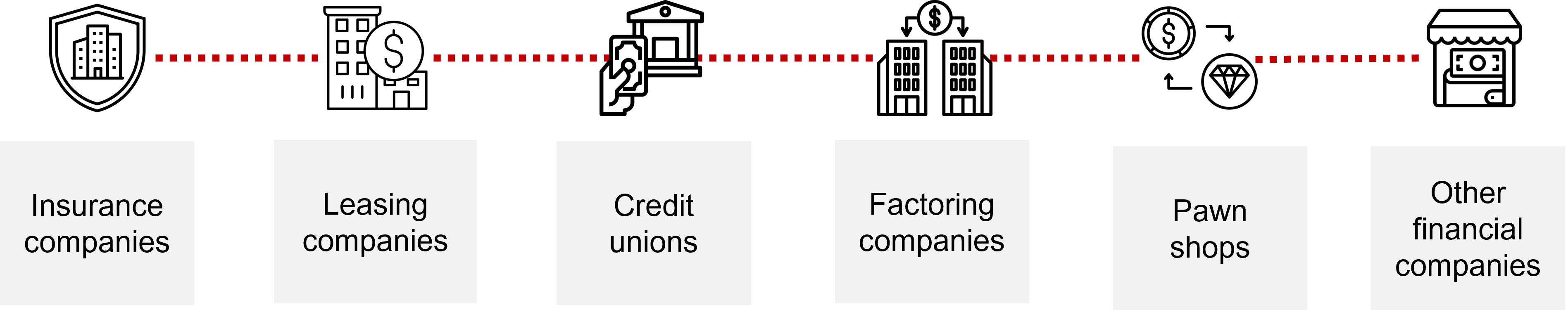

Activities that will be affected by the new regulations:

It is worth noting that a number of important innovations are contained in the draft regulation on the authorization of financial service providers and the conditions for their activities in the provision of financial services, which will replace the current regulation on the licensing of financial service providers. Major changes will include the following:

- The procedure for reissuing existing licenses, as well as expanding and narrowing the scope of the license for the type of activity of providing financial services;

- The procedure for attracting and including subordinated debt in the capital by NBFI;

- Regulation of outsourcing for the performance of certain functions to contractors and partners of a licenced institution;

- Updated requirements for owners of significant participation, authorized capital, business reputation, professional suitability of managers and key persons, etc.

The new regulations are part of the NBU's broader strategy for regulating the financial sector of Ukraine, which can be found on website of the official online representation of the NBU. Financial institutions who are already providing services or who are planning to start providing services should consider the updated requirements and prepare to meet them as soon as they have entered into force.