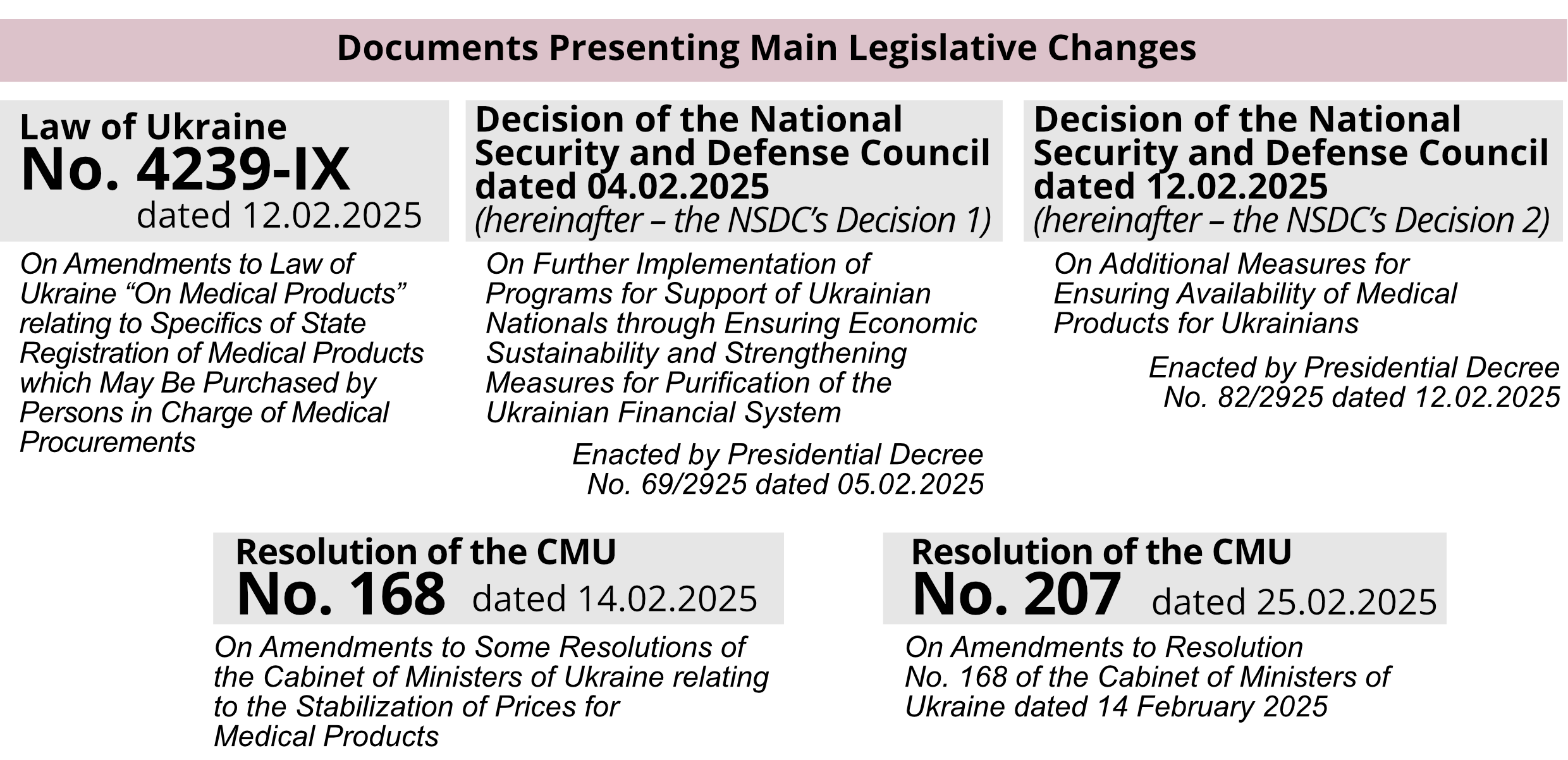

The pharmaceutical market in 2025: key changes

In this update

Promotion of medical products – new rules of the game

. Temporary ban > read

. New restrictions > read

Price regulation – what is new?

. Introduction of reference pricing policy for manufacturers/importers > read

. Restrictions on supply and sales markups for distributors > read

. Introduction of threshold trade (retail) markups for pharmacies > read

Restrictions on sales of goods to distributors > read

Ongoing investigations and studies being conducted by the AMCU at pharmaceutical markets – change of focus > read

Conclusion > read

In 2025, the pharmaceutical sector will undergo significant changes which will affect all market players – from manufacturers to pharmacies and pharmacy chains. This overview presents the main novelties relating to the promotion of medical products, price regulation, distribution of medical products, and their potential business consequences.

Promotion of Medical Products – New Rules of the Game

Temporary Ban on Medical Products' Promotion

The Antimonopoly Committee of Ukraine (hereinafter – "AMCU") has repeatedly highlighted certain problems that exist in terms of the promotion of medical products which affect the competitive environment. In particular, the absence of promotion rules for medical products for all pharma market players became one of the concerns presented by the AMCU in its Report based on Research of Pharma Markets back in 2016.

At the end of December 2024, Viktor Liashko, the Minister of Health of Ukraine, in an online interview “Minister of Health of Ukraine: Medical Industry during War. Part 4” said that the draft guidelines “Medical Products. Proper Promotional Practices” would soon be published for public discussion. As of the date of this article, the draft guidelines have not yet been published.

In the absence of regulatory guidance, the impact of medical products' promotion on the cost of pharmaceuticals served as the grounds for a temporary ban on marketing activities aimed at end consumers.

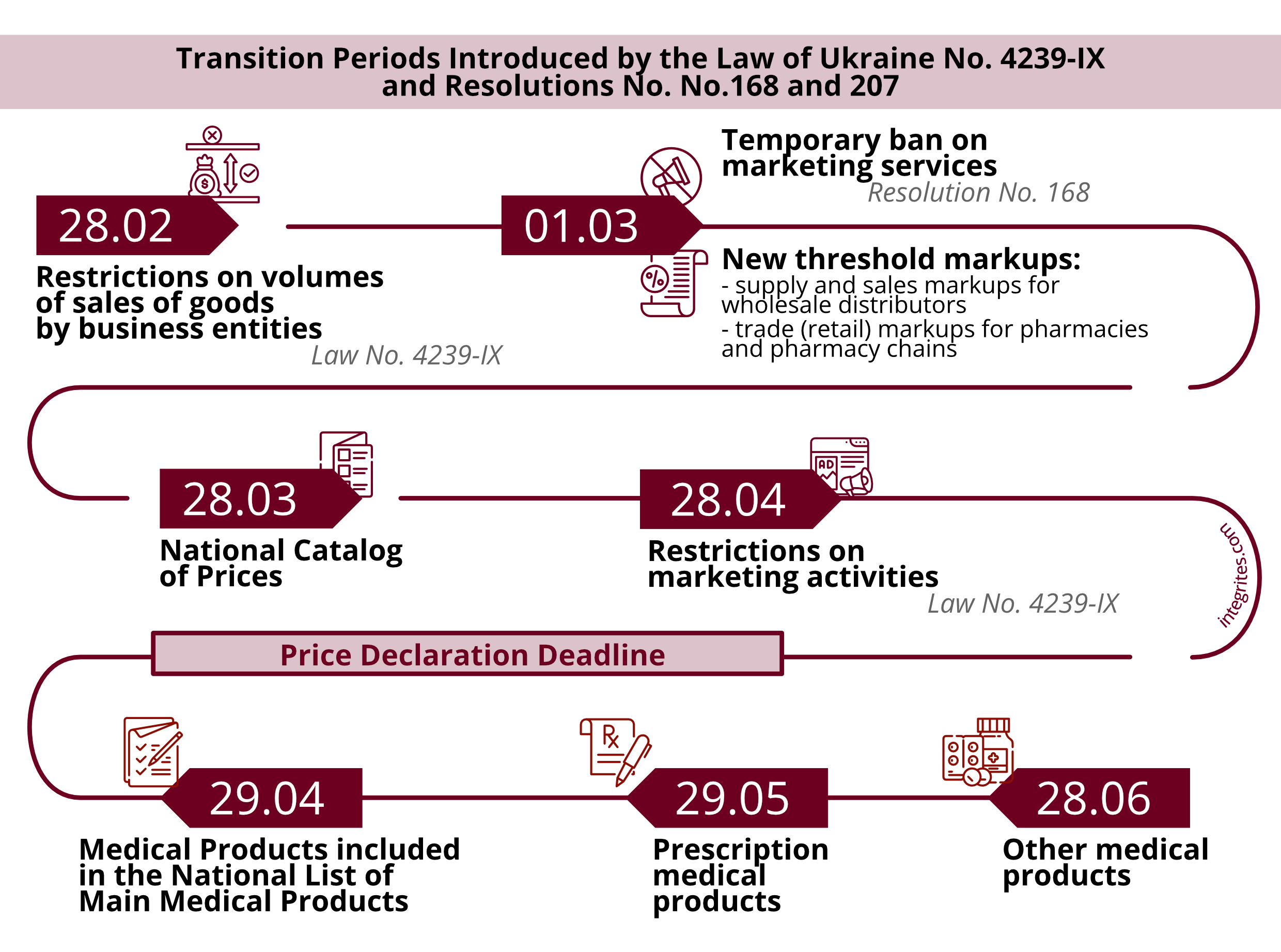

Thus, according to Resolution No. 168 adopted to execute the NSDC’s Decision 2, from 1 March 2025 till the introduction by the CMU of a specific reference policy in terms of wholesale prices for all medical products it is prohibited to provide marketing services, medicines' promotion services, information and other services associated with the sales of medical products to end consumers.

The only exception to these rules is the performance of operations providing for full or partial reimbursement of the cost of medical products sold within socially oriented programs for support of patients which are only sold for the sake and benefit of end consumers.

It is necessary to mention that such bans are set out in the Licensing Terms and Conditions for conducting business activities for the production of medical products, wholesale and retail trade in medical products, import of medical products (except for active pharmaceutical ingredients), and therefore the violation of these newly introduced rules means the violation of the license terms and conditions.

Restrictions on Medicines' Promotion

The restrictions set forth in Law No. 4239-IX are permanent, unlike the restrictions set forth in the NSDC’s Decision 2 and Resolution No. 168 (as amended by Resolution No. 207), which are temporary.

Law No. 4239-IX supplements Law of Ukraine No. 123/96-BP “On Medical Products” dated 04.04.1996 with Article 201 which imposes the following restrictions on the business of selling medical products:

Within two months upon entry of Law of Ukraine No. 4239-IX into force, the CMU must approve the procedure and terms of provision for marketing services. This will contribute to setting clear and transparent game rules for all pharmaceutical market players.

Price Regulation – What Is New?

Introduction of New Price Regulations

New mechanisms have been developed to reduce the cost of medical products based on the NSDC’s Decision 1 and the NSDC’s Decision 2. Law 5239-IX and Resolution No. 168 establish new maximum markups applied to both the public sector and the pharma segment.

At the same time, even when the new price regulation was being discussed, pharmaceutical market players as well as various industry associations and public organizations, including the American Chamber of Commerce in Ukraine and the European Business Association, expressed their concern about the efficiency of such methods, which imply enhanced regulation and control by the state.

It is worth mentioning that according to Article 12 of the Law of Ukraine, “On Prices and Pricing”, state regulated prices must be economically justified, i.e. prices for goods must correspond to expenses for their production and sale, as well as ensure a profit from selling the same.

However, since draft Law No.4239-IX is primarily related to the specifics of the state registration of medical products which may be purchased by an authorized person in charge of healthcare, its supporting documents contain no information on economic justification of prices. Moreover, this draft law, as amended for the second reading, was not sent to the AMCU for it to analyse how these novelties influence competition

Despite the uncertainty surrounding the consequences of such regulation, pharmacy manufacturers chose to cooperate with state authorities and signed a declaration on the reduction of prices by 20% for all medical products and by 30% for one hundred of the most popular items among consumers.

Introduction of Reference Pricing Policy for Manufacturers/Importers

Law No. 4239-IX provides for the introduction of a National Catalog of Prices for which manufacturers and importers of medical products will be obliged to declare their prices for goods.

It is important to mention that these declared prices must not exceed reference prices to be set based on the average value of the three lowest prices for a respective medical product (according to the international non-patented name) in reference countries.

Considering the example of reference pricing for medications included in the National List of Main Medical Products, we can assume that candidates for the role of reference countries are the Republic of Poland, the Republic of Slovenia, the Czech Republic, the Republic of Latvia, and Hungary.

The National Catalog of Prices will be revised once every six months or if the official exchange rate of UAH to the conventional unit (USD or EUR) changes by more than 5% compared with the official exchange rate of the National Bank of Ukraine as of the first business day of the month which follows such a fluctuation.

Therefore, the introduction of the reference pricing policy for manufacturers and importers may result in additional obstacles for these business entities, as medications which do not comply with reference prices cannot be included in the National Catalog of Prices. Thus, some medications may disappear from pharmacy shelves or become less available for ultimate consumers. This, in its turn, can result in a reduced number of competitors in their respective markets and, consequently, in weaker competition, and lower physical accessibility of medical products for consumers.

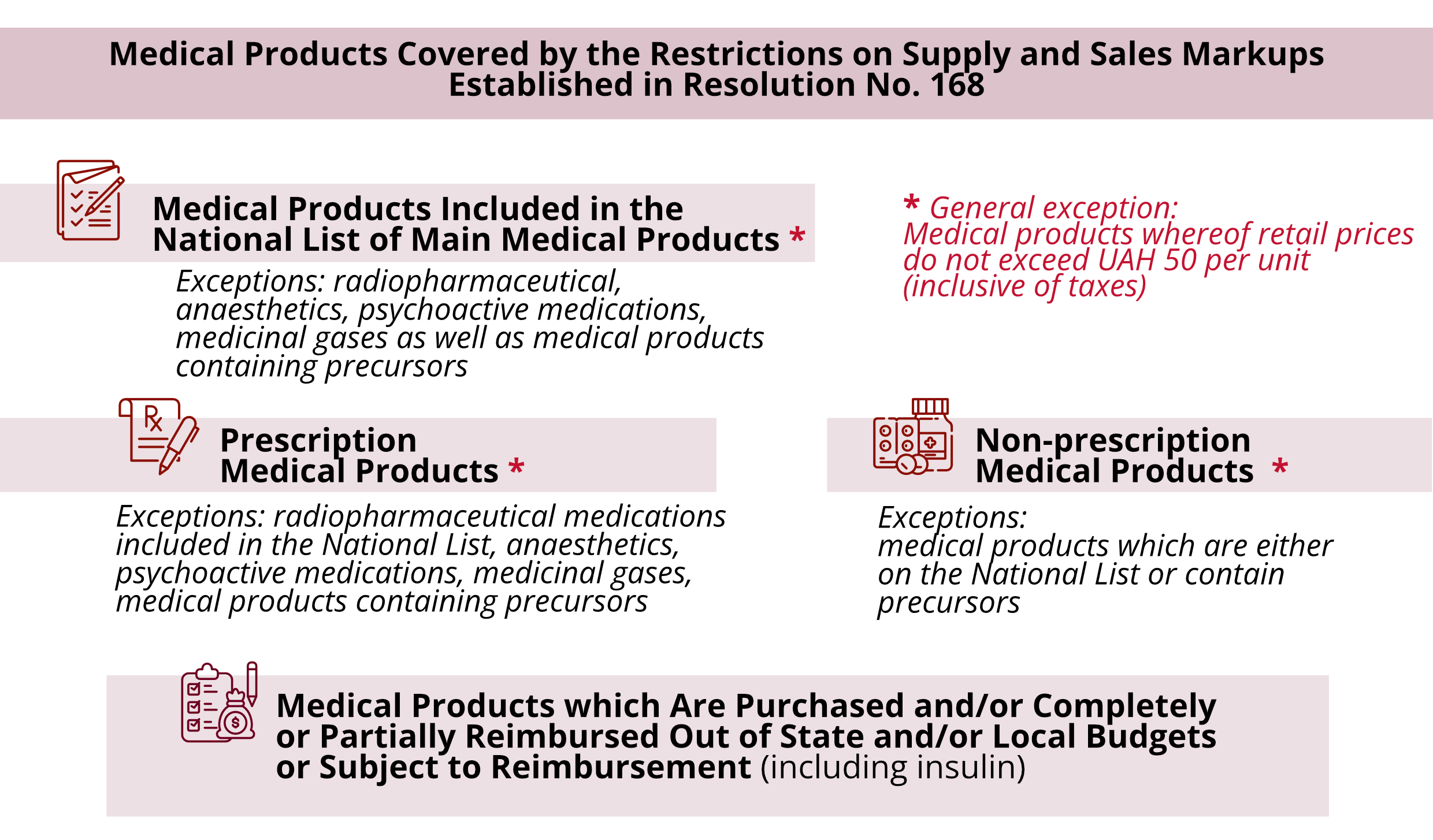

Restrictions on Supply and Sales Markups for Distributors

Both Law No.4239-IX and Resolution No. 168 establish restrictions on supply and sales markups amounting to 8% (except for cases established by the law, as set forth below in this article).

However, there is some difference between Law No. 4239-IX and Resolution No. 168. According to Law No. 4239-IX, supply and sales markups will only apply to medical products which will be in the National Catalog of Prices after the expiry of a respective transition period.

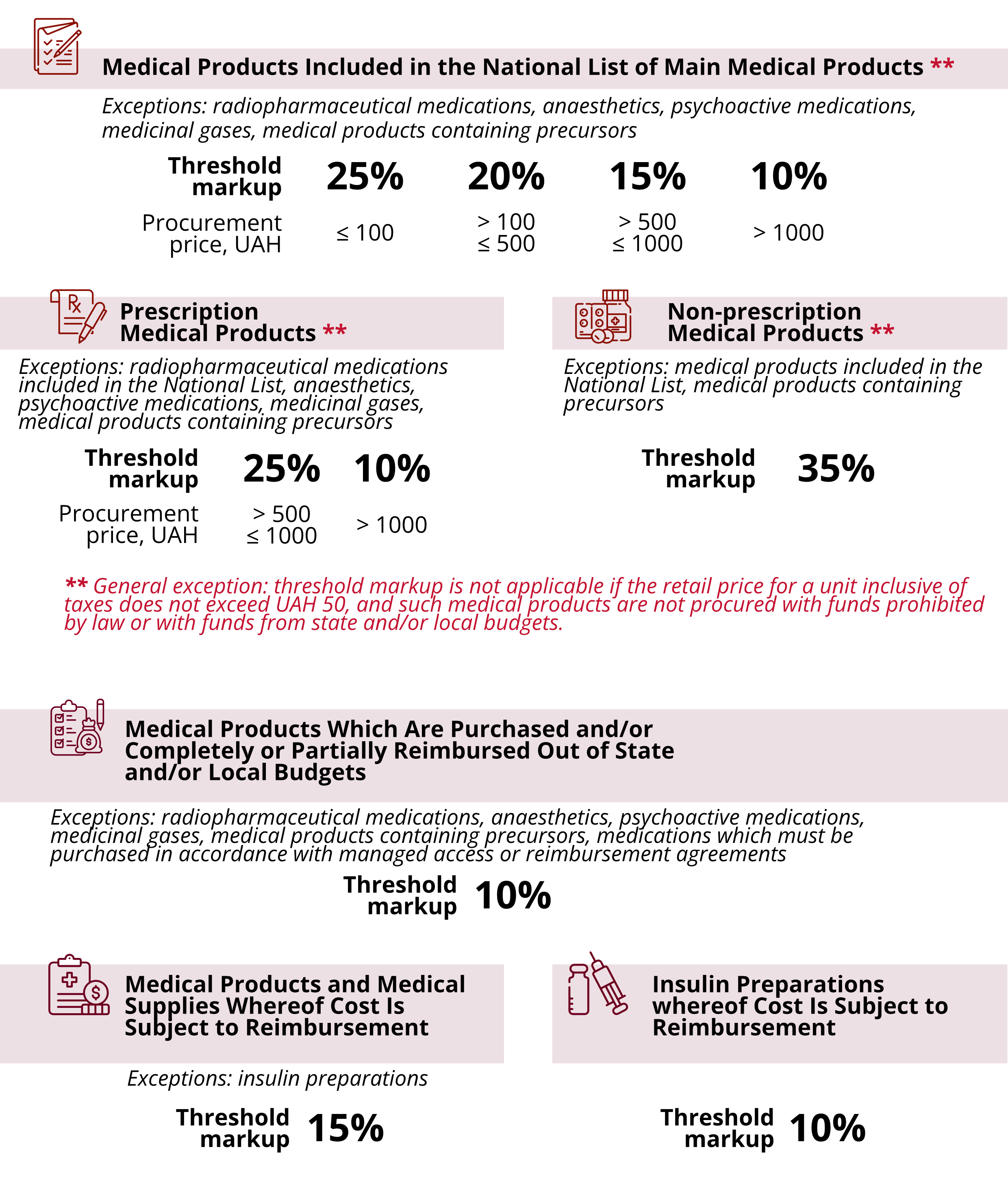

Introduction of Threshold Trade (Retail) Markups for Pharmacies

The maximum retail markup is established by Resolution No. 168, and its amount depends on the category a medication belongs to and/or its price:

Resolution No. 168 establishes additional restrictions on trade markups for wholesale and retail market players which, starting from 01.03.2025, also apply to medications that previously did not have restrictions in terms of threshold supply and sales markups and/or threshold trade (retail) markups.

Restrictions on Sales of Goods to Distributors

In November 2023, the AMCU gave Recommendations No. 7-рк “On Measures to Promote Competition, Prevent Breaches of Laws on Protection of Economic Competition and Termination of Actions which May Affect Competition” (hereinafter – the "Recommendations") regarding multiple refusals by manufacturers and importers of medical products to conclude and extend supply agreements as well as unreasonable restrictions on sales of goods for medical product distributors.

According to market players, manufacturers and importers apply restrictions on the volume of supplies for all distributors except for BaDM Limited Liability Company (hereinafter – "BaDM LLC") and Optima-Pharm, LTD which is a Ukrainian-Estonian joint venture formed as a limited liability company (hereinafter – JV “Optima-Pharm, LTD” LLC) whereof market share was 81.84% in 2021, and 85.29% in 2022.

The abovementioned facts prove the problems existing in the pharmaceutical market's competitive environment which are associated with the increased market concentration of two market players which prevail over other distributors.

To solve these problems, Law No. 4239-IX was supplemented with new provisions which, in the members of parliament's opinion, will remedy the market's situation.

Law of Ukraine “On Medical Products” (No. 123/96-BP dated 04.04.1996) was supplemented with Article 204 which establishes a new obligation for manufacturers and importers of medical products: Within a calendar year they must sell ready-made products on equal terms in volumes which do not exceed 20% of the net proceeds from sales of these ready-made products for the previous calendar year in Ukraine. This rule applies to sales to the same business entity, including sales to all other business entities which are directly or indirectly connected to it through control relations.

Equal terms include:

- prices;

- payment terms and due dates; and

- terms of delivery.

In addition, these laws were amended with a provision relating to cases in which a business entity does not ensure the purchase of the entire volume of ready-made products from a manufacturer/importer of medical products. In such cases,a manufacturer/importer of medical products may sell ready-made products for the amount exceeding 20% of net proceeds from sales of these ready-made products for the previous calendar year to a business entity which has a higher effective consumer demand for a particular medical product.

Ongoing Investigations and Studies Being Conducted by the AMCU at Pharmaceutical Markets – Change of Focus

Over the course of 2024 and in the beginning of 2025, the AMCU focused on the study of two key segments of the pharmaceutical market: wholesale distribution and retail sales of medical products.

In June 2024, the AMCU started considering Case No. 126-26.13/102-24 based on the claimed violation committed by “BaDM LLC” and JV “Optima-Pharm, LTD” LLC by setting similar sale prices for medical products, including Spasmalgon, Eucazolin Aqua, and others, as well as similar price increase dynamics and similar behaviour in terms of pricing policy for medical products, including Spasmalgon, Eucazolin Aqua and others in 2019-2023.

This case demonstrates a change of the AMCU’s focus in terms of pharma investigations.

Whereas previously the Committee investigated concerted practices of wholesale distributors together with manufacturers/importers of medical products and/or pharmacy chains, the AMCU now focuses on competition issues directly at the wholesale distribution level.

At a meeting in the Presidential Office on 25 February 2025, Pavlo Kyrylenko, the Chair of the AMCU, said that their investigation is in the final stage. The AMCU will prepare a submission with preliminary conclusions by the end of April. This means that the Committee has completed the collection of evidence and its analysis of the case. The next step will be to decide in the case as to the qualification of the actions by “BaDM LLC” and JV “Optima-Pharm, LTD” LLC.

In February 2025 and in order to execute the NSDC’s Decision 1, the AMCU started an additional investigation of pharma markets regarding pricing, pricing procedure and abuse of market power throughout the entire medication supply chain(from manufacturer to pharmacy) within which the AMCU sent requests for information to 13 medical product manufacturers. As far as we understand, marketing agreements are also covered by the investigation.

In addition, local AMCU offices are investigating regional specifics of the purchase and sale of medical products by pharmacies and pharmacy chains. This investigation seeks to study competition among pharmacies and relationships between and among pharmacies and wholesale distributors.

Висновок

Considering the AMCU’s ongoing investigations and studies, the Ministry of Health's position and the NSDC’s decisions, 2025 may become a make-or-break year with regard to state regulation of the pharma market. It is essential for all pharma market players to be attentive to these legislative amendments and to adapt their businesses to these new requirements. This will not only help avoid potential sanctions but also facilitate an increase of public and regulatory confidence in the pharmaceutical sector.

The review was prepared by the experts of INTEGRITES Antitrust and Competition Practice INTEGRITES

Nataliya Kovalova Counsel  Yaroslava Liamchenko Associate

|